Sheikh Hamdan aims to place UAE among world’s top 10 space economies by 2031

UAE launches the National Space Industries Program that aims to enhance the competitiveness of the UAE’s space sector and support national and international companies operating within it.

The Program was announced during the Supreme Space Council’s second meeting chaired by Sheikh Hamdan, Crown Prince of Dubai, Deputy Prime Minister, Minister of Defence and Chairman of the Supreme Space Council.

The Program includes a comprehensive package of initiatives and policies to attract and support both emerging and established space companies. It aims to boost investment, enhance market access, and promote knowledge transfer across sectors. The initiative also seeks to double the number of space firms and UAE’s space exports within five years.

Sheikh Hamdan said: “Driven by this vision, we are working to increase the value added by the space economy by 60%, double its overall returns and position the United Arab Emirates among the world’s top ten space economies by 2031.”

During the meeting, Sheikh Hamdan reviewed the new strategic approach for the space sector built around three main objectives:

Positioning the UAE as a hub with the most agile, investment-friendly space ecosystem

Establishing the country as a global leader in space partnerships and market access

Ensuring the nation possesses world-class space infrastructure and facilities that meet the highest international standards.

Sheikh Hamdan said the new strategy reaffirms the UAE’s commitment to building a world-class space ecosystem powered by strong private-sector partnerships. He noted that global interest in the UAE’s space initiatives reflects international confidence in the country’s dynamic economy, robust regulations, and advanced infrastructure. He emphasized the goal of doubling investments and the number of national companies in the space sector, reaffirming the UAE’s ambition to become a global hub for advanced technologies, innovation, and future industries.

Space Economic Survey

The survey revealed a 49% increase in total public and private sector spending on space over the past five years, a clear expression of a collective commitment to building an integrated and sustainable ecosystem. Spending on space research and development also increased ninefold since 2019, underscoring the UAE’s focus on scientific leadership and the development of competitive technologies that will shape the future of the country’s space sector.

The Middle East space economy is gaining global visibility, with the UAE leading the charge as the region consolidates its ambitions in the fast-expanding space sector.

According to a new report by Boston Consulting Group (BCG), the Middle East and Africa (MEA) space market is valued at $18 billion and is projected to grow at a compound annual rate of 5 per cent through 2033. With the UAE commanding a market share of between 40 and 45 per cent, the nation has enhanced its reputation as the regional hub for space innovation and economic diversification.

The UAE’s commitment to space exploration and commercialisation is underscored by its $443 million investment in civil space activities in 2024 — an amount that accounted for almost half of total government spending on space across the MEA region. More strikingly, the UAE is poised to capture more than 50 per cent of the regional downstream services market, covering areas such as satellite communications, navigation, and Earth observation, which together represent about 70 per cent of the global space industry’s value.

Saudi Arabia and Qatar are also emerging as important players, investing around $220 million each in 2024. Saudi Arabia, with an estimated 20 to 25 per cent share of regional government spending, is aiming for more than 20 per cent of the downstream services segment, while Qatar contributes about 5 per cent. Collectively, the GCC countries are positioning themselves as leaders in a sector once dominated by established global powers.

Analysts highlight that the UAE’s commanding role is not the outcome of short-term spending but rather the result of more than a decade of strategic planning, sustained investments, and public-private collaboration. “The UAE’s leadership in the Middle East space market reflects a clear example of how government vision, when matched with private sector innovation, can yield disproportionate influence in a highly competitive field,” said Faisal Hamady, Managing Director and Partner at BCG.

Space market experts said with decade-long project timelines and significant capital commitments, the UAE and its GCC peers appear ready to embrace this challenge. “Their collective leadership, anchored by the UAE’s dominant role, places the region on a clear trajectory to become one of the most dynamic contributors to the global space economy.”

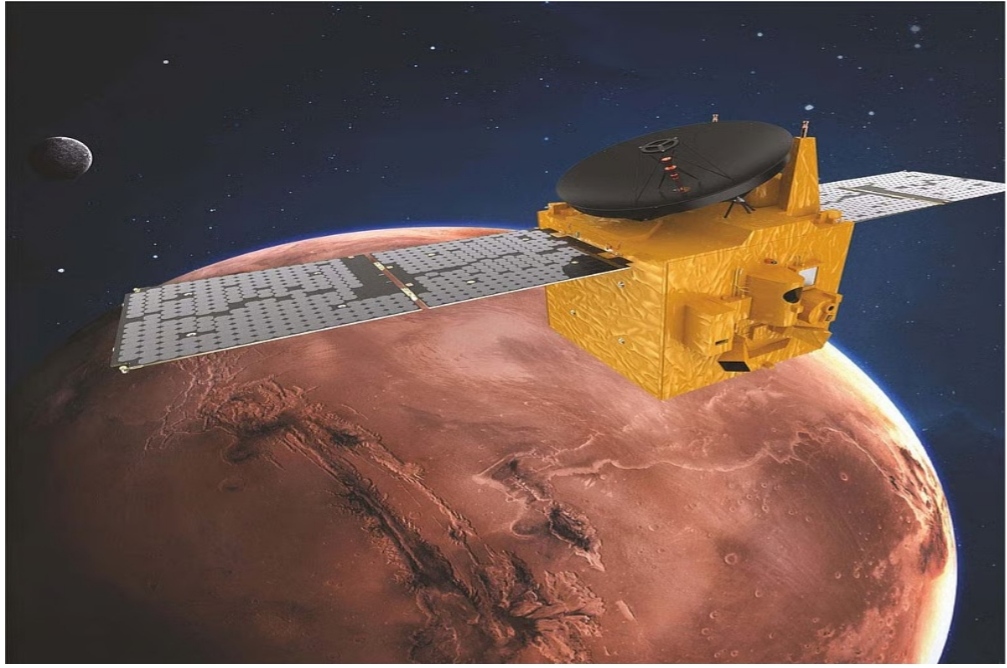

The UAE’s flagship missions — such as the Hope Probe to Mars, the MBZ-SAT satellite, and the collaborative Arab 813 satellite initiative — are now seen as yielding potential returns of up to three to four times the initial investment. These projects are aligned with six factors that BCG identifies as critical for space economy success: long-term strategic vision, robust public-private partnerships, portfolio diversification, a tolerance for risk, international collaboration, and integration of digital-space policy.

Saudi Arabia and Qatar are following a similar trajectory, focusing on global partnerships and hybrid investment models. Riyadh has forged collaborations with NASA and Axiom Space, while also building local capacity through entities such as Neo Space Group. Qatar’s Es’hailSat has become a crucial player in regional satellite communications. Meanwhile, the UAE has continued to emphasize international cooperation, sharing mission frameworks with space agencies and research institutions worldwide.

The growing space economy is expected to create broad economic multipliers across sectors such as telecommunications, autonomous vehicles, smart cities, and climate monitoring. Satellite broadband services, low-Earth orbit (LEO) constellations, and Earth observation systems are already shaping policy planning, infrastructure deployment, and national security frameworks across the region.

In the UAE, the integration of digital technologies into space applications has been prioritized, with particular focus on satellite data use for climate resilience, disaster management, and urban planning. The BCG report argues that such digital-space convergence will form the backbone of future economic transformation, opening opportunities in artificial intelligence, big data, and blockchain-enabled satellite services.

For emerging space nations in the region, the analysis advises focusing on “niche excellence” — areas where specific strengths can be scaled globally — while building strong regulatory frameworks and talent development pipelines. For leaders like the UAE, the next phase involves accelerating innovation clusters, expanding public-private partnerships, and maximizing synergies between space-based and terrestrial technologies.

Globally, the space economy is estimated to be worth several hundred billion dollars, with forecasts suggesting it could surpass $1 trillion by 2040, according to Morgan Stanley and PwC. The UAE’s sustained focus on positioning itself as a leading player in this frontier economy is therefore both a strategic and economic imperative, aligning with its long-term diversification goals under “We the UAE 2031” and beyond.

“Across the GCC, there is a recognition that space industry success is not built overnight,” said Thibault Werle, Managing Director and Partner at BCG. “It requires excellence in funding, partnerships, policy integration, and above all, patience for long-term returns.”