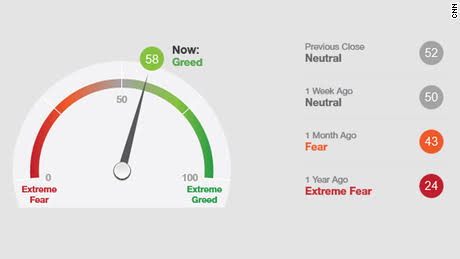

Fear and Greed index on stock market

By

Triston Martin

According to a well-known Wall Street proverb, fear and greed are the only two emotions that matter when it comes to the market. Even though this is an oversimplification, there are times when it rings true. On the other hand, giving in to these feelings may significantly damage investors’ investment portfolios, the stability of the stock market, and even the economy as a whole. Understanding market psychology is the subject of a significant body of academic research that goes by behavioral finance and encompasses a large body of published material.

The Influence of Greed

The vast majority of people aim to amass wealth as quickly as possible, and bull markets encourage us to test our luck at doing so. The explosion of the internet industry in the late 1990s is a good illustration. At the time, it seemed that all an advisor needed to do to propose an investment was to add the word “dotcom” to the end of the offer, and investors would jump at the chance. A frenzy has set up about the accumulation of internet-related equities, many of which are barely fledgling companies.

Investors were excessively greedy, which fueled even more purchasing and bidding, driving prices to excessively high heights. It finally burst, causing a decline in stock values between 2000 and 2002, as was the case with many previous asset bubbles throughout history.

“Greed is good,” was a famous line from the movie Wall Street that the fictitious investor Gordon Gekko said. However, this mentality of “get rich fast” makes it difficult to maintain a disciplined long-term investment plan, which is particularly challenging in an environment that the former chair of the Federal Reserve, Alan Greenspan, memorably referred to as “irrational exuberance.”

A Lesson From the “Oracle of Omaha”

Warren Buffett, who mostly disregarded the dot-com boom and had the last laugh on those who labeled him wrong, exemplifies the clear-eyed, long-term investment that is an example for other investors to follow. Buffett did not deviate from his tried-and-true method, known as value investing. This requires disregarding speculative trends to focus on purchasing shares of publicly traded firms that the market has mispriced.

The Influence of Fear

Fear may take hold of the market in the same way that greed can make it impossible to trade effectively. When a stock market suffers significant losses over a prolonged period, investors might become collectively scared of more losses, which causes them to start selling their holdings. This, of course, reinforces itself, which guarantees that prices will go down even lower. Herd behavior describes what occurs when investors purchase or sell only because everyone else is doing it. Economists have given this phenomenon a name.

In the same way that greed rules the market while it is booming, fear is the dominant emotion when it is crashing. Investors swiftly sell equities and purchase safer assets, such as stable-value funds, money-market securities, and principal-protected funds, which are all low-risk but low-return securities. This is done to halt the progression of losses.

Following the Herd vs. Investing Based on Fundamentals

This widespread withdrawal from stock markets demonstrates a shocking lack of appreciation for patient investment based on basic analysis. A significant amount of your stock holdings indeed disappearing is a bitter pill, but if you don’t participate in the eventual rebound, you’re just making things worse for yourself. In the long term, investors who choose low-risk assets pay an opportunity cost in the form of foregone profits and compounding growth that, in the end, more than makes up for the losses sustained due to a down market.

A significant hole may be torn in your portfolio if you abandon your investment plan in favor of the most recent get-rich-quick trend. However, the same thing can happen if you evacuate the market along with the rest of the herd, which often departs the market at precisely the wrong moment. If you are not fully involved, you should make purchases when the herd sells off its holdings. In such a scenario, you should hang on for dear life.

The Importance of Comfort Level

The inherent unpredictability of the stock market is the root cause of all of this rhetoric about fear and greed. When investors find themselves outside their comfort zones due to losses or unstable market conditions, they become susceptible to these emotions, often resulting in highly expensive blunders.

Stay focused on the market’s fundamentals rather than allowing yourself to get carried away by the dominating market mood of the day, which may be influenced by excessive fear or greed. Determine the appropriate mix of assets to hold. Your exposure to stocks should be lower than that of persons with a high-risk tolerance since you are more likely to be more easily frightened if you are highly risk-averse. As a result of this, you should be more cautious.