China to set up a stock exchange in Beijing to bolster capital market

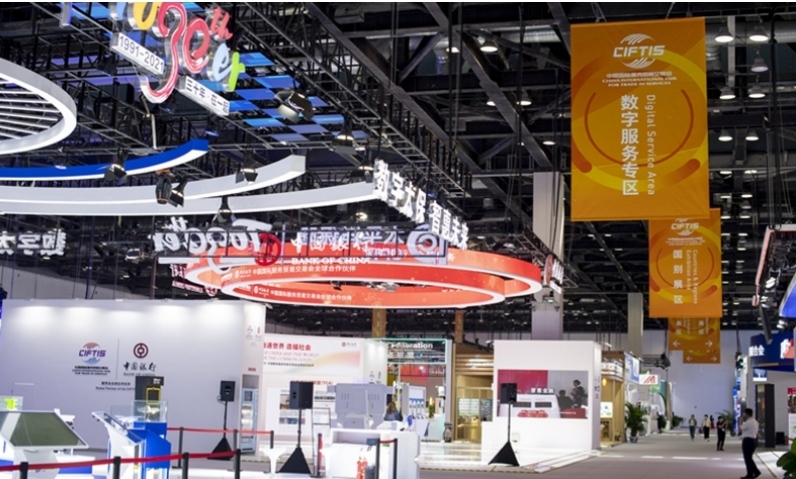

The exhibition area for digital services at the 2021 China International Fair for Trade in Services in Beijing on September 1, 2021

China will set up a stock exchange in Beijing and build the capital city into a major base for innovative small and medium-sized enterprises (SMEs), Chinese President Xi Jinping announced on Thursday.

The move will improve the multi-level structure of China’s capital market, making it more dynamic and resilient, and will play a significant role in the country’s push for innovation-driven high-quality growth, officials and analysts noted.

The move also comes as China has prioritized efforts to prevent major financial risks through tightening regulations and as the US continues to push for a financial decoupling by cracking down on US-listed Chinese firms.

Addressing the 2021 China International Fair for Trade in Services (CIFTIS) via video, Xi said that China will continue to support the innovation-driven development of SMEs by setting up a Beijing Stock Exchange as the primary platform serving innovation-oriented SMEs, the Xinhua News Agency reported.

China will also deepen the reform of the National Equities Exchange and Quotations, known as the “New Third Board,” according to Xinhua.

The establishment of a stock exchange in Beijing and reform of New Third Board are major new strategic arrangements for improving the service of the capital market and promoting its high-quality development, an official with the China Securities Regulatory Commission (CSRC), the top securities regulator, said on Thursday.

The role of the Beijing Stock Exchange is to serve innovative SMEs. Stock exchanges in Beijing, Shanghai and Shenzhen will follow complementary development and interconnect with one another. The Beijing Stock Exchange and the New Third Board will also coordinate and retain institutional linkages to maintain the balance of the market structure, the CSRC explained.

“Actually, there have been some discussions in the market about setting up a new stock exchange in China’s northern or central areas, since the two other exchanges concentrate on the economically developed Yangtze River Delta and Pearl River Delta, and Beijing was one of the potential candidates,” Dong Dengxin, director of the Finance and Securities Institute of Wuhan University, told the Global Times on Thursday.

Innovation-oriented SMEs have lacked a platform like the sci-tech innovation board of the Shanghai Stock Exchange or the NASDAQ-style ChiNext board of the Shenzhen Stock Exchange, as these two have higher entry thresholds in terms of both scale and requirements for high technology, said Dong.

However, as the nation pushes ahead with its economic transformation and breakthroughs in high technologies, which have become more pressing amid the trade war with the US, more efforts are needed to accelerate innovation among SMEs, Dong noted, adding that the Beijing Stock Exchange will form a better stage together with the New Third Board for SMEs that are technology oriented.

The New Third Board was launched in early 2013 to supplement the Shanghai and Shenzhen stock exchanges to serve SMEs.

“Given that more US-listed Chinese firms are going for secondary listings in the home market, the need for a new trading venue has also arisen,” an industry insider, who asked to remain anonymous, told the Global Times.

“But how to develop it in a complementary way with the Shanghai and Shenzhen stock exchanges, and come up with a new design of the rules, requires more down-to-earth efforts.”

The top securities regulator also said on Thursday that it will coordinate the capital market development on multiple levels, promote and improve the capital market system to serve the innovation and development of SMEs, and build a professional development platform for the capital market that suits China’s national conditions.

The CSRC said that it will strive to build a standardized, transparent, open, dynamic and resilient capital market.

China will also optimize the rules governing the services sector, by supporting Beijing and other localities in piloting the alignment of domestic rules with the ones in high-standard international free trade agreements and in building demonstration zones of digital trade, according to Xinhua.

It was also significant that the announcement of the new stock exchange was made at the CIFTIS, which is a major platform for cooperation in services trade, underscoring China’s commitment to further boost cooperation with global partners.

More than 10,000 enterprises from 152 countries and regions have registered for online and offline exhibitions for CIFTIS. The number of companies exhibiting on-site has jumped 6 percent from 2020.

Among all the exhibiting enterprises, 21 percent are among the world’s top 500 and leading enterprises in the industry, and 18 percent are international ones, Shu Jueting, spokesperson of the Ministry of Commerce, said on Thursday during a press briefing.

China’s services trade deficit fell 70 percent from January to July this year on a yearly basis, with services exports reaching 1.34 trillion yuan ($207 billion), up 23.3 percent year-on-year, while imports stood at 1.47 trillion yuan, down 4 percent year-on-year, said Shu.

Source : Global Times