The next height of Propaganda after Hindenburg report failed to destabilize Indian Economy

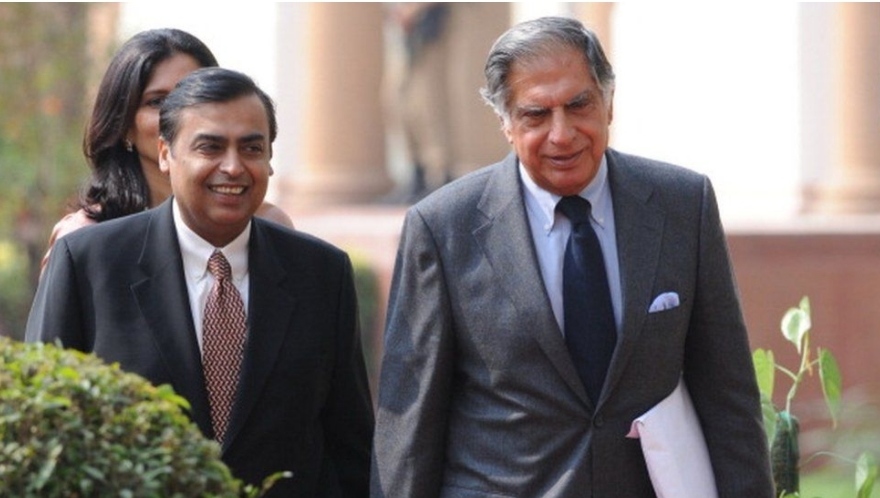

The ‘Big 5’ include Mukesh Ambani’s (left) Reliance Group and Tata group, formerly led by Ratan Tata (right)

Well BBC will just not give up. After releasing a propaganda documentary on Gujrat riots which had taken place around 20 years, now they are trying to advice India to break up its large business private conglomerates which has started beating the Western business conglomerates in their own turfs.

So a BBC article says that India should dismantle its large conglomerates to increase competition and reduce their ability to charge higher prices Whose brain wave this…. former Reserve Bank of India deputy governor Viral Acharya. He has argued in a new paper for Brookings Institution, an American research group.

So when the Hindenburg report failed to destabilize Indian economy, they have roped in a former banker who is now a professor of economics at NYU Stern. What crap they must be teaching there. It’s surprising why this banker was not teaching the Americans how to save and salvage their own collapsing banks ???

As per this banking Acharya “industrial concentration” – which refers to the extent to which a smaller number of firms account for total production in a country – fell sharply in India after 1991 when the country opened up its economy and state-owned monopolies began giving away their market share to private enterprises. But after 2015, it began rising again. These chaps will not talk about how strongly the Navratna Public Sectors Undertakings are performing in India.

The share of India’s “big five” conglomerates – the Reliance Group, Adani Group, Tata Group, Aditya Birla Group and Bharti Airtel – in total assets of non-financial sectors rose from 10% in 1991 to nearly 18% in 2021.

They “grew not just at the expense of the smallest firms, but also of the next largest firms”, says Mr Acharya, because the share in total assets of the next five business groups halved from 18% to 9% during this period.

There could have been many drivers of this, according to Mr Acharya – their ability to acquire large distressed companies, a growing appetite for mergers and acquisitions, and India’s conscious industrial policy of creating “national champions via preferential allocation of projects and in some cases regulatory agencies turning a blind eye to predatory pricing”.

The trend raises several concerns, according to the former deputy governor. These include “the risk of crony capitalism, i.e., political connections and inefficient project allocations, related party transactions within their byzantine corporate organisation charts”, taking on excess debt to fund their expansion and preventing competitors from entering the market.

He should have first advised the West to dismantle all the giant multinational companies of theirs and only then start advising India what to do.

Viral Acharya was a deputy governor at the Reserve Bank of India and we all k ow what happened in that period.

Excess leverage was, in fact, one of the many red flags that US-based short seller Hindenburg Research had also raised against the Adani Group recently. The report initially led to billions of dollars being wiped from the stock market. However the Indian share market has bounced back and already a large part of that “wealth “ is back. In fact it is Hindenburg whose future is in doldrums.

In other countries this has had far graver spillover effects in the past.

“National champions can easily become overleveraged and collapse, severely damaging the overall economy, as has occurred in other Asian countries, most spectacularly Indonesia in 1998,” Josh Felman, former India head of the International Monetary Fund, told the BBC.

In a February column for Project Syndicate, the economist Nouriel Roubini had also expressed concerns about India’s economic model of giving a few “national champions” or “large private oligopolistic conglomerates” control over significant parts of the economy.

“These conglomerates have been able to capture policymaking to benefit themselves,” wrote Mr Roubini. The phenomenon was stifling innovation and disallowing entry of start-ups and other domestic entrants in key industries, he said.

India’s policy of creating “national champions” is similar to those adopted by China, Indonesia and particularly South Korea in the 1990s, where a group of mostly family-run business conglomerates – called chaebols, of which smartphone giant Samsung is the most prominent example – dominated its economy.

But unlike India, these countries “did not protect their conglomerates with sky-high tariffs”, says Mr Acharya. India, however, has been becoming more protectionist in order to “insulate domestic industries and conglomerates from global competition”, Mr Roubini wrote.

As per these experts and Economic Acharyas all of this has major implications on India’s attempts to become the next factory of the world. We’ll we Indians certainly appreciate their deep concern for our economy….but we will do what we think is right. RIGHT ?

Roubini let out the cat by stating..”The phenomenon was stifling innovation and disallowing entry of start-ups and other domestic entrants in key industries, he said.

India’s policy of creating “national champions” is similar to those adopted by China, Indonesia and particularly South Korea in the 1990s, where a group of mostly family-run business conglomerates – called chaebols, of which smartphone giant Samsung is the most prominent example – dominated its economy.

But unlike India, these countries “did not protect their conglomerates with sky-high tariffs”, says Mr Acharya. India, however, has been becoming more protectionist in order to “insulate domestic industries and conglomerates from global competition”, Mr Roubini wrote.

So all are really batting for exporting their goods to India but tariff free !!!!!